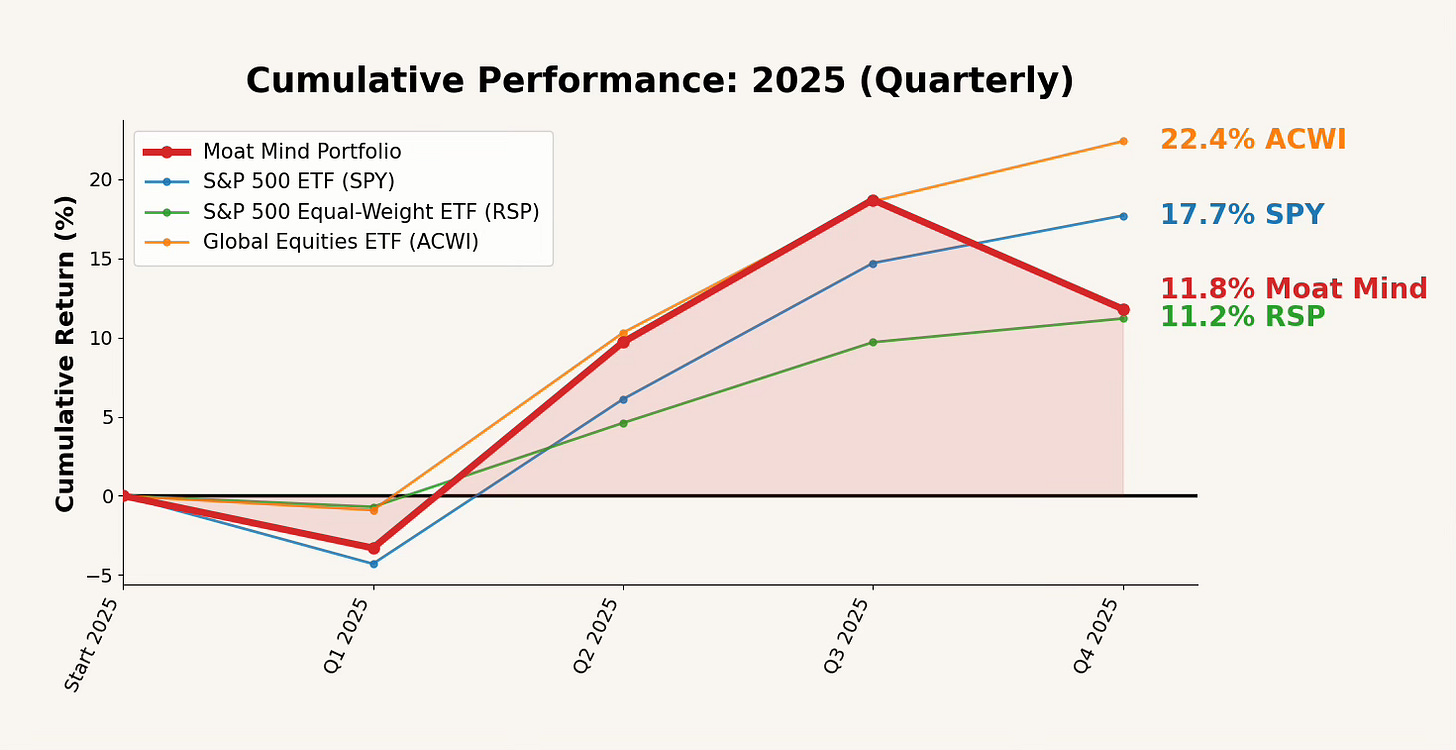

2025 Portfolio Update — YTD: +11.8%

Jan–Dec 2025: +11.8% YTD, versus ACWI +22.4%, SPY +17.7%, and RSP +11.2%

The Moat Mind Portfolio finished 2025 up 11.8%. That’s a positive absolute year, but it trailed global equities (ACWI) and the S&P 500 (SPY), while landing roughly in-line with S&P 500 equal weight (RSP).

The key story of the year is timing: through the end of September the portfolio was up +18.7% YTD and sitting at/near the top versus the same benchmarks, but Q4 gave back ~6.9 percentage points of performance (from +18.7% to +11.8%) while the benchmarks continued to grind higher.

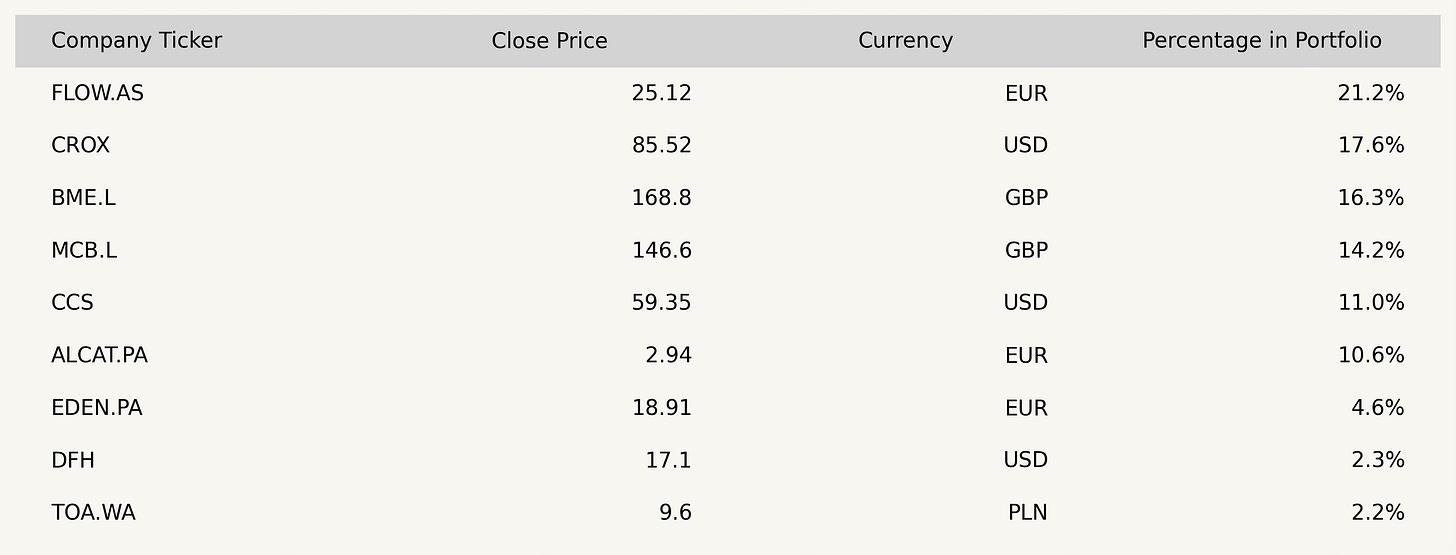

Portfolio updates can be found in the Portfolio section.

Looking ahead to 2026

My focus going into 2026 is unchanged: own a small set of businesses where I believe the moat, balance sheet, and reinvestment runway can drive compounding over a multi-year window. After a year where relative performance swung materially by quarter, the priority is ensuring each position still clears the bar on fundamentals and valuation.

Interesting that the portfolio tracked RSP more closely than SPY. That Q4 giveback is brutal but it actually tells you something useful about your holdings. When equal-weight underperforms cap-weight by that much, it usually means the mega caps (particularly the Mag7) were doing all the heavy lifting while breadth was weaker. The fact that you held up through Sept and then gave backsome of those gains in Q4 suggests you might have been positioned more in quality mid-caps or diversified names rather than being overweight the handful of names that drove SPY's outperformance. Given how concentrated SPY has become, being inline with RSP isn't necessarily a bad benchmark, especially if you're focused on moats and reinvestment runways like you mentioned.