Portfolio Update - February 2025

A Tough Month for Moat Mind, but Long-Term Discipline Remains Key

February 2025 was a challenging month for the Moat Mind portfolio, which posted a -5.6% return, significantly underperforming its benchmarks. While year-to-date performance remains flat (0.0%), short-term volatility has tested patience. In contrast, equal-weighted (RSP) and global (ACWI) indices fared better, each up 2.8% YTD, while the S&P 500 (SPY) has gained 1.4%.

Since inception, Moat Mind still holds a positive 1.6% return, though lagging behind SPY (6.4%), ACWI (4.9%), and RSP (3.7%). The recent downturn underscores the importance of long-term strategy, focusing on quality businesses with durable economic moats. While short-term fluctuations can be frustrating, true value emerges over time.

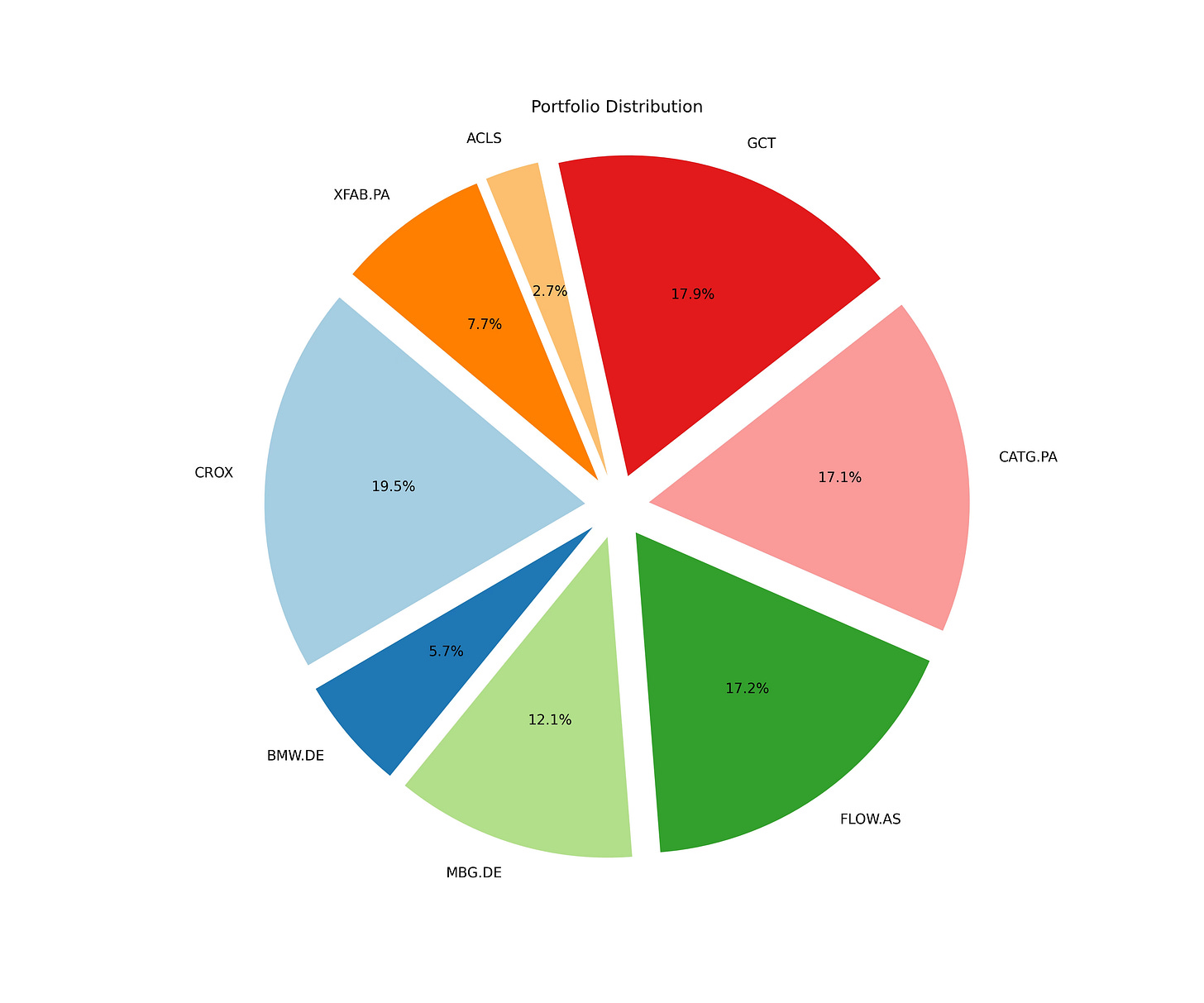

This month we increased our positions in X-FAB (XFAB.PA) (1), Crocs (CROX) (2) and GigaCloud Technology (GCT) (3). Below is the updated portfolio distribution by end of February 2025.