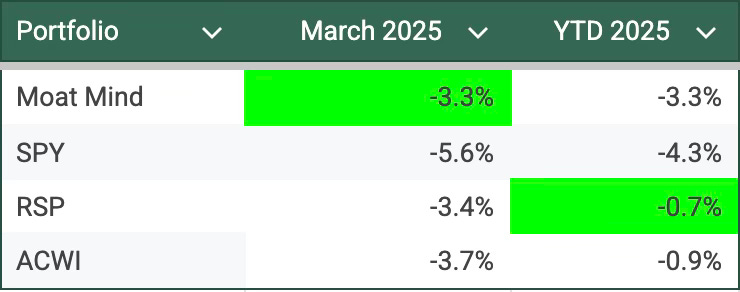

March 2025 was another turbulent month for equities, but the Moat Mind portfolio showed relative strength, posting a -3.3% return. This compares favorably to the S&P 500 (SPY) at -5.6%, the equal-weighted RSP at -3.4%, and the global ACWI index at -3.7%.

Year-to-date, Moat Mind stands at -3.3%, outperforming SPY (-4.3%) but lagging RSP (-0.7%), and ACWI (-0.9%). While the broader market continues to face macro pressures, the portfolio’s focus on durable, high-quality businesses has helped cushion the downside.

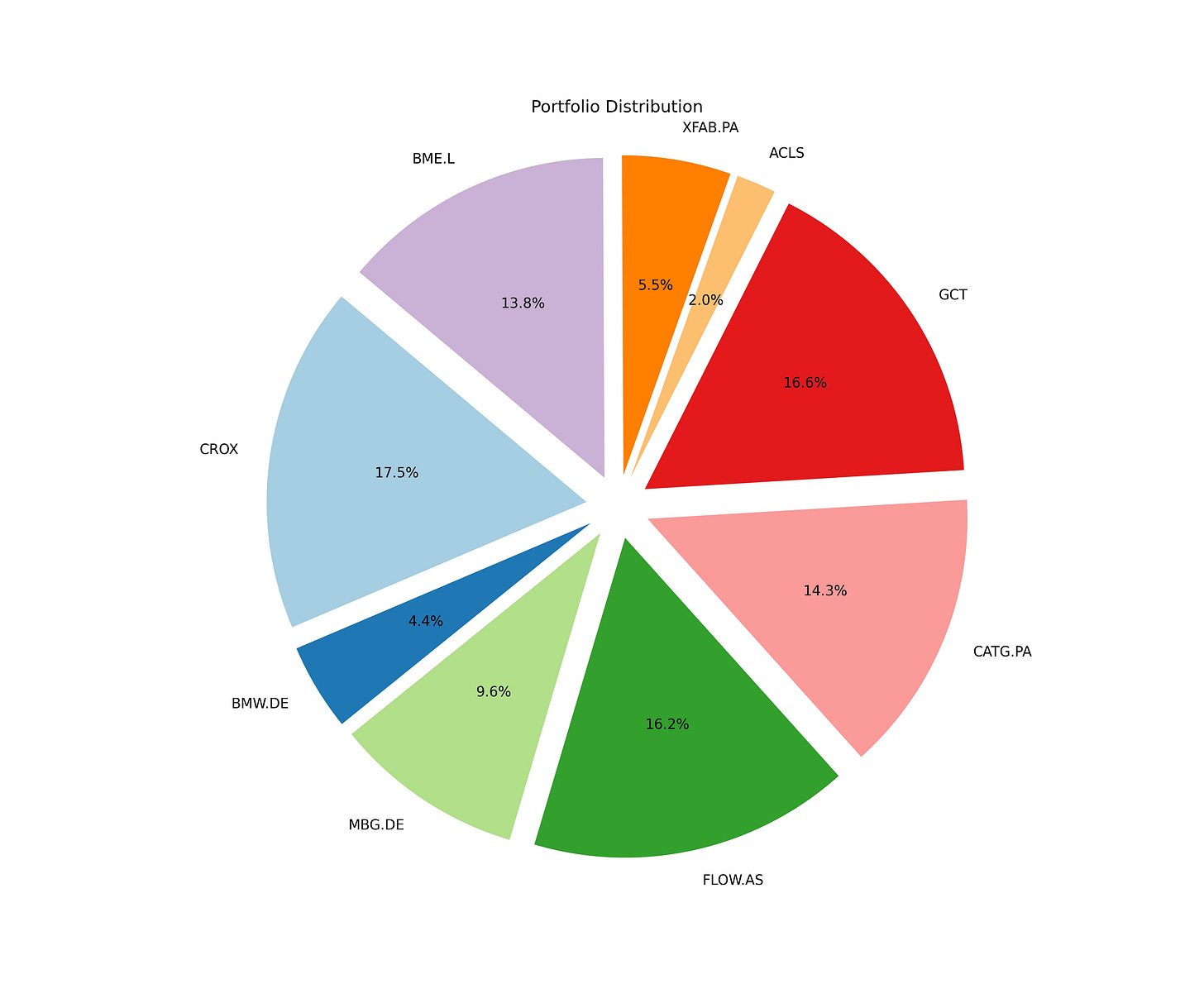

This month we added a new stock to portfolio B&M European Value Retail (BME.L) (1), (2) and increased our positions in GigaCloud Technology (GCT) (3) and Catana Group (CATG.PA) (4).

Disclaimer: The views expressed on Moat Mind are solely for informational and educational purposes and do not constitute financial or investment advice, nor an investment recommendation. The author is not acting as an investment adviser and does not provide personalized financial guidance. This content is not a comprehensive analysis of any security and is not a substitute for independent research—including review of SEC filings and consultation with a qualified financial professional. Although the information is based on sources believed to be reliable, its accuracy and completeness are not guaranteed, and opinions are subject to change without notice.

Disclosure: The author may hold positions in, or trade, the securities discussed without further notice. Example portfolio performance is not a promise of future returns, and past performance does not guarantee future results. You are solely responsible for your investment decisions, and Moat Mind disclaims any liability for losses incurred. Always consult a qualified financial advisor before making any investment decisions.