How I Use Expected IRR to Drive Buy and Sell Decisions

Forget static price targets. Expected IRR (Internal Rate of Return) reframes investing as a dynamic, comparative process—one grounded in evolving fundamentals and real-time market signals.

Traditional valuation asks, “What is this worth?”

I ask, “What return am I likely to earn from here?”

That’s the question expected IRR answers—and why it’s at the core of every decision I make.

🧭 Key Takeaways

IRR beats DCF (Discounted Cash Flow) for practical investing

Expected IRR (Internal Rate of Return) gives a clearer, more intuitive lens than traditional DCF. It turns valuation into a forward-looking return expectation that’s easier to compare across stocks.IRR shifts with two forces: price and assumptions

When prices move—or your assumptions about the company change—IRR adjusts. That’s the heartbeat of active portfolio management.Assumptions move slow. Prices move fast.

Fundamental shifts happen quarterly (earnings), occasionally (industry news), or rarely (you realize you were wrong). But prices change every day—creating IRR-driven entry and exit points constantly.IRR makes opportunity cost explicit

Investing is always about choosing this stock over that one. IRR makes that trade-off explicit by highlighting where capital can work harder.Not precision, but clarity

IRR isn’t precise—1–2% swings are just noise from different inputs. But 5%+ differences often point to true fundamental divergence. That’s signal.

💡 Why IRR? Why Not Just Stick with DCF?

Switching from traditional DCF models to IRR makes comparing investments simpler and more intuitive—without sacrificing rigor.

1. One Clear Metric

IRR expresses potential returns as a single annualized percentage, making it easier to understand than abstract NPV values. Instead of “Stock A is worth $10 more,” you can say “Stock A offers a 14% return.”

2. Straightforward Cross-Comparison

Different business models, payout structures, or growth rates? IRR levels the playing field. It lets you rank investments by expected return on a consistent basis.

3. No Arbitrary Discount Rate

DCF models require picking a discount rate—often debated and subjective. IRR skips that by solving for the rate that equates future cash flows to the current price.

4. Same Rigor, More Clarity

IRR uses the same cash flow inputs as DCF, so the underlying logic remains robust. But it reframes valuation into a usable decision tool that reacts to price changes.

5. Aligns With Real-World Thinking

Investors think in annual returns. IRR matches that mindset, helping you compare stocks to each other—or to alternatives like bonds or ETFs—with speed and clarity.

If you’re curious about the full discussion, I broke it down here:

👉 From Discounted Cash Flow to Internal Rate of Return

⚙️ How I Apply IRR in My Portfolio

Understanding why IRR matters is just the beginning. Here’s how I actually use it in my portfolio decisions—step by step.

1. Build a Forecast

Every investment starts with a core thesis. Forecast revenue growth, margins, reinvestment, and terminal value. Keep it realistic. This is the “assumption layer.”

2. Solve for IRR

Given today’s stock price, what IRR would I earn if those forecasts play out? That’s my “expected IRR.”

3. Monitor the Price → Recalculate IRR

Price drops = IRR goes up (potentially more attractive)

Price spikes = IRR goes down (potentially overvalued)

Even if nothing changed about the business.

4. Update Assumptions Slowly, Deliberately

Assumptions change with:

Earnings results

Major news (M&A, regulation, capital allocation)

Realizing I misjudged the moat or growth path

But this is infrequent. Unlike price.

5. Compare Across the Portfolio

I maintain a live dashboard of IRRs for all my holdings. This lets me ask:

“Where is my next dollar best deployed?”

If one stock offers 14% and another just 8%, I start thinking about reallocation—assuming conviction is equal.

📘 Want to learn how I calculate IRR step by step?

👉 Here’s my full walkthrough on DCF and IRR modeling

⚠️ IRR Is a Compass, Not a GPS

It’s tempting to treat IRR mechanically:

“Anything below 9%, sell.”

“Buy anything over 14%.”

But applying IRR rigidly overlooks nuance.

IRR is sensitive to assumptions—and assumptions are uncertain. Small differences can swing IRR by 1–2%. That’s likely within the margin of modeling error.

But 5%+ gaps?

That’s worth investigating. Either:

The market’s mispricing something,

My model is off,

Or it's time to reallocate.

📊 Real-World IRR Snapshot

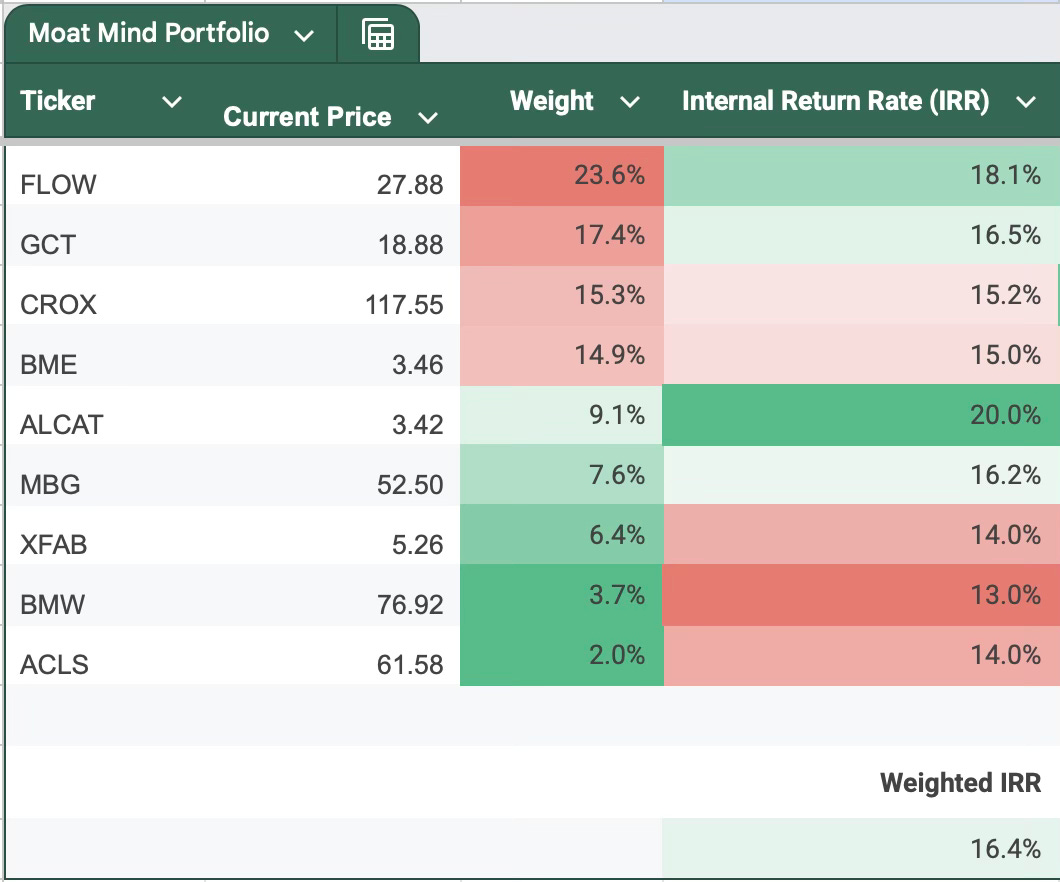

Here’s a real-time view of my current portfolio: each holding’s weight, current price, and expected IRR based on my forward model assumptions.

Key takeaways from this table:

— FLOW, GCT, CROX and BME are my top allocations. Each offers a compelling expected IRR above 15%, with FLOW leading at 18.1%.

— ALCAT stands out with the highest expected IRR (20.0%), but it currently sits at only 9.1% weight. This is not a mistake. Its high IRR is largely due to a recent price drop, which also reduced its weight in the portfolio. That price-action-driven dislocation may represent an opportunity.

— XFAB, BMW, and ACLS show sub-14% IRRs—still attractive in absolute terms, but less compelling than others. These may be candidates for trimming if better opportunities arise.

— My portfolio-weighted IRR sits at 16.4%, which is the blended forward return expectation assuming all assumptions hold.

This snapshot helps me decide:

Where to add more capital (high IRR + low weight = likely buy signal)

Where to hold steady (balanced IRR and conviction)

Where to trim or exit (low IRR + high allocation)

📈 This table isn’t static. It is updated automatically by a script as prices change and when I change fundamental assumptions. That’s the advantage of using expected IRR—it keeps my capital allocation process dynamic, probabilistic, and responsive.

✅ Final Thought

Expected IRR doesn't predict the future—it clarifies it.

It helps cut through emotion and narrative. It turns valuation into an ongoing strategy, not a one-time analysis. And it forces you to think in terms of opportunity cost—not just price.

IRR is how I stay rational in an irrational market.

It’s how I stay invested—not just in stocks, but in process.

How many stocks do you follow

in your paid subcription