B&M European Value Retail S.A. (BME.L) – In-Depth Analysis and Valuation

B&M European Value Retail: A High-Margin UK Discount Giant Trading at a Bargain—Deep Dive into Financial Strength, Competitive Moat, and Growth Potential

High-Margin UK Discount Giant with an operating margin exceeding 10%, trading at a P/E of 8x and a P/FCF of 5x. Over FY21-FY24, it has distributed £1.8B in dividends—equivalent to two-thirds of its £2.7B market cap. Over the past decade, revenue has compounded at 14.7% annually (total growth: 294%), while diluted EPS has soared at a 27.0% annually (total growth: 992%).

B&M European Value Retail S.A. ("B&M") has evolved from a single-store operation in northwest England in 1978 into a major discount retail group with over 1,100 stores across the UK and France. The company's aggressive expansion strategy, focus on variety discount retailing, and ability to offer high-demand products at ultra-competitive prices have solidified its position as a leading player in the sector. This document provides an in-depth analysis of B&M’s business model, competitive advantages, financial stability, and future growth prospects. By examining key performance metrics, industry trends, and management strategies, we aim to assess the company's long-term investment potential.

Table of Contents

1. Business Overview

B&M European Value Retail S.A. (“B&M”) is a leading discount retailer operating a chain of variety stores offering a broad mix of general merchandise and groceries. The business began as a single store in 1978 in northwest England and was later expanded under the Arora family, who acquired 21 stores in 2004. Today, B&M has grown into a major value-retail group with over 1,100 stores across the UK and France. This footprint includes 741 B&M-branded stores in the UK, 335 Heron Foods convenience stores (a discount grocery subsidiary), and 124 B&M stores in France as of March 2024. B&M is headquartered in the UK (with a Luxembourg parent entity) and is publicly listed on the London Stock Exchange as a FTSE-250 constituent.

Products and services: B&M’s stores sell a wide assortment of branded products spanning fast-moving consumer goods (FMCG) like food, beverages, toiletries, and cleaning supplies, as well as general merchandise such as household goods, toys, DIY products, furniture, apparel, and seasonal/holiday items. The retailer follows a “variety discount” model – offering many categories under one roof at bargain prices. Its product range truly runs the gamut “from hats and heaters to toys and food,”. This breadth of offering, with an emphasis on everyday essentials alongside occasional treasure-hunt finds, positions B&M as a one-stop shop for value-seeking customers. Many stores also include garden centers, and B&M’s Heron Foods chain specializes in frozen and fresh foods, extending the group’s reach in daily grocery needs.

Customer base and market positioning: B&M targets value-conscious shoppers across a broad demographic spectrum. Initially popular among lower-income groups, the chain has increasingly attracted middle-income households, especially during recent inflationary times as discount shopping has become more socially accepted. With over 3 million shoppers per week (according to the company) and a focus on “big brands at sensational prices,” B&M’s value proposition resonates strongly during a cost-of-living crisis. In fact, around half of B&M’s revenue comes from staple food and FMCG products, which helps draw regular traffic and “has allowed the Group to remain insulated from any downturn in consumer spending” by catering to everyday needs. Geographically, B&M’s core market is the UK – it operates nationwide, with a particularly dense store network in England and strong presence in Scotland, Wales, and Northern Ireland. In France, B&M entered via the 2018 acquisition of the Babou chain (since rebranded to B&M) and has been growing steadily, now with 100+ stores. The company’s Luxembourg incorporation provides a base for European expansion and reflects its multinational scope. Overall, B&M is positioned as a high-growth discount retailer offering a mix of grocery essentials and discretionary goods under an “everyday low price” strategy that appeals to families looking to stretch their budgets. Management emphasizes that B&M plays an “important role in helping a large number of customers afford their everyday essentials”amid rising living costs. This strong value-for-money ethos underpins B&M’s brand and drives customer loyalty and frequent repeat visits.

2. Competitive Moat

Industry landscape and key players: B&M operates in the discount variety retail sector, which has seen rapid growth across Europe. Alongside peers like Action (Netherlands-based) and Pepco (owner of Poundland in the UK and Pepco stores in Europe), B&M has been a leading player in this exploding market (FMCG Brands Can Cash In On Discount Variety Retail’s Success). In the UK, B&M’s primary competitors include other bargain/variety chains such as Home Bargains (TJ Morris Ltd.), Poundland, and (historically) Wilko, as well as the discount supermarkets (for FMCG categories) and general merchandise retailers. Notably, B&M has established itself as the UK’s #1 variety goods value retailer, outpacing most rivals in store count and revenue. Its scale is significant – for context, Wilko had around 400 stores before its collapse, and Poundland about 800 – and B&M’s >1,100 store estate (including Heron Foods) gives it extensive reach. The competitive environment is fragmented, but consolidating: weaker players have struggled with the UK’s tough retail climate, exemplified by Wilko’s bankruptcy in 2023. B&M capitalized on this by purchasing 51 of Wilko’s store leases for just £13 million (UK discount retailer B&M to buy 51 stores of collapsed Wilko | Reuters), swiftly converting them to B&M shops and hiring over 2,100 ex-Wilko staff. This opportunistic acquisition not only expanded B&M’s footprint at low cost, but also underscored its strength relative to competitors. Internationally, Action (with ~€11B sales in 2023) is a formidable privately-held rival expanding in France and recently entering the UK, and Pepco Group (which operates Poundland in the UK and Dealz/Pepco in Europe) is also pursuing growth. Nonetheless, B&M’s entrenched UK position, successful French integration, and multi-format strategy (large B&M Home Stores and smaller Heron Foods outlets) give it a robust platform in face of competition.

Competitive advantages and economic moats: B&M has several durable advantages that constitute its economic moat in the discount retail industry:

Scale and Buying Power: B&M’s large scale allows it to purchase goods in high volume directly from manufacturers (especially in Asia) at very low cost. It imports a significant portion of general merchandise from China/Far East and maintains a broad supplier base. Its scale advantage was evident when B&M emerged as a “major customer”for many suppliers, leveraging excess manufacturing capacity in the Far East to negotiate favorable terms. This purchasing clout enables B&M to offer branded products at prices often lower than even supermarkets’ own brands. Maintaining a strong price gap to competitors is a stated priority. As a result, B&M can deliver on its promise of “very low prices both in absolute and comparative terms,” a key driver of the sector’s success.

Low-Cost Operating Model: The company runs a very lean operation, which reinforces its cost leadership. Stores are typically no-frills (often in warehouse-style or secondary retail park locations with low rents), staffing is efficient, and there is minimal spend on fancy fixtures or elaborate displays. Corporate overhead is kept low and processes are kept simple. B&M’s management explicitly focuses on “high operational standards and keeping costs low,” which in turn allows everyday low pricing for customers. This self-reinforcing loop – low costs enabling low prices – is core to B&M’s moat. Even as input cost inflation surged recently, B&M engaged suppliers constructively to resist excessive price hikes, “continuing to ensure stores are well-stocked with best-selling products at attractive prices relative to competitors,” thereby protecting its price-leader reputation. The result is strong profitability despite low margins per item, because volume is high and expenses are tightly controlled.

Broad Assortment & “Treasure Hunt” Experience: Unlike single-category discounters, B&M carries a wide assortment across FMCG and general merchandise. This breadth (with focus on variety rather than deep stock of any single SKU) means customers can find a bit of everything in one trip. Importantly, the product mix is constantly refreshed – B&M rotates seasonal goods and special buys frequently, creating a “treasure hunt” shopping experience. Shoppers never know what new bargain they might find, which drives repeat visits and impulse purchases. This treasure-hunt element is a competitive differentiator versus more predictable retailers. B&M also mixes well-known brand-name products with closeout deals and own-label lines, using end-of-line clearances and special imports to surprise customers. The fast turn of inventory and strong sell-through of seasonal ranges (as evidenced by excellent holiday sales performance in toys, home décor, etc. show how B&M’s model encourages customers to buy now or miss the deal, boosting demand.

Everyday Essentials Traffic Driver: While the thrill of a bargain hunt brings in shoppers, a crucial part of B&M’s model is that roughly 50% of sales are from essential groceries and consumables. By providing everyday necessities (food, toiletries, pet food, cleaning supplies, etc.) at discount prices, B&M ensures steady footfall and basket spend. Customers who come in for bread and milk may leave with a new kitchen gadget or garden ornament as well. This blend of staple and discretionary goods is a moat in that it hedges the business – essentials generate reliable revenue even in downturns, while discretionary items deliver higher margins in better times. Few competitors strike this balance as well. B&M’s ownership of Heron Foods (small format grocers mainly in Northern England) further strengthens its presence in daily essentials and convenience shopping, complementing the larger home stores.

Rapid, Profitable Store Expansion: B&M has a proven ability to roll out new stores at high returns on capital. Management reports that new B&M stores have a payback period of under one year on investment – an exceptionally fast return that underscores the model’s viability in new locations. This is due to relatively low fit-out costs and immediate customer demand in value-starved markets. Such rapid payback means each new store quickly contributes to cash flow, and the more stores B&M opens, the stronger its buying scale and distribution efficiency become (economies of scale). The company’s disciplined site selection and use of standardized, low-cost fit-outs are part of this advantage. In addition, B&M has shown it can readily backfill vacated retail space left by struggling competitors (e.g. former Woolworths or Wilko sites), turning others’ failure into its gain. The availability of retail space in the current market – as some traditional retailers downsize – actually “offers opportunities for new stores” for B&M, reinforcing its growth runway.

Collectively, these factors give B&M a competitive moat characterized by cost leadership, a strong brand for value, and a virtuous cycle of cash generation funding further growth and low prices. B&M’s industry-leading return on capital (exceeding 30% annually) attests to the strength of its model. In fact, the company’s success and scale are such that it has been able to return substantial cash to shareholders while continuing to expand rapidly, which few brick-and-mortar retailers can achieve simultaneously.

Industry trends, risks, and growth opportunities: The macro environment is a mixed backdrop of challenges and opportunities for B&M. On one hand, UK retailers face headwinds from high inflation, rising interest rates, and increases in corporate taxes, which have dampened consumer confidence and spending power. Many major retail chains have warned of a tough year ahead in 2024–2025 as shoppers tighten their belts. However, value-focused retailers like B&M tend to outperform in such downturns, as consumers “trade down” from higher-end stores to discounters. Indeed, the current cost-of-living crisis in Britain has driven more customers into B&M stores seeking bargains on essentials. B&M’s management notes that its value-for-money proposition plays an important role for households facing budget pressure, which has helped the company gain market share while some mid-market retailers struggle. The discount variety sector as a whole is expected to keep growing strongly – analysts project the European market will expand by ~30% (around €17 billion) by 2028. This growth is fueled by both new store openings and rising like-for-like sales as more consumers embrace discounters. B&M is well positioned to capture a good portion of this expansion given its aggressive rollout plans (discussed in Section 8).

Key growth opportunities for B&M include: continuing to densify its UK store network (especially in underpenetrated areas or by upsizing older stores), expanding its French business (France’s population and retail market size are comparable to the UK, suggesting “similar scale” potential long-term), and steadily growing Heron Foods across the UK (the convenience segment where Heron competes has players with 2,000+ stores, versus Heron’s 335, indicating a long runway). Additionally, B&M may selectively pursue acquisitions of small regional chains or opportunistic asset purchases (as with Heron in 2017 and Wilko stores in 2023) to bolster growth. The company’s proven ability to integrate acquisitions and improve their profitability (e.g. turning around the formerly struggling Babou stores in France, which now have “good profitability with strong underlying margins”) bodes well for any future deals.

Despite these positives, B&M faces several risks and competitive challenges. One risk is intensifying competition: as the discount sector’s success attracts attention, rivals like Action are expanding rapidly (Action’s sales nearly tripled in five years to 2023) and could encroach on B&M’s markets. In the UK, privately-owned Home Bargains is also expanding and has a very similar model and size, which could lead to store battles in some locales. Additionally, e-commerce remains a disruptive force in retail – while B&M has largely sidestepped it (believing that selling low-priced, bulky items online is not cost-effective), the rise of online marketplaces and Amazon’s growing assortment of inexpensive goods means some competition for non-food sales. B&M has minimal online sales presence, which is a strategic choice but could be a vulnerability if consumer buying behavior shifts more decisively online for its product categories in the future.

Another industry risk is inflation and supply chain volatility. B&M imports a large share of general merchandise from Asia, so it is exposed to freight costs, currency exchange rates (pound vs. dollar/Euro), and potential supply disruptions. The company acknowledges that any serious disruption – e.g. escalation of geopolitical tensions (like a China-Taiwan conflict) – could force costly adjustments in sourcing. To mitigate this, B&M maintains alternative supply sources and carries ample buffer stock for imported goods (which proved effective during recent shipping delays in the Red Sea). Still, geopolitical or logistical shocks remain a risk factor. Domestically, cost inflation in wages and energy could pressure margins if not offset. B&M’s strategy of negotiating hard with suppliers and its low-cost culture help counter this: for example, it has been agile in adapting product mix and pricing, even introducing more “entry price point” items to cater to squeezed consumers.

In terms of demand resilience and pricing power, B&M has shown remarkable resilience in various economic climates. During the COVID-19 pandemic, B&M was deemed an essential retailer (due to selling food and necessities) and stayed open, resulting in strong trading and a surge in profits and cash flow. The company emerged from the pandemic larger and financially stronger – group revenues increased by ~50% and over £2.0 billion was returned to shareholders from 2020-2024. This illustrates that B&M can actually thrive in adverse times that force consumers to seek value. In a recessionary scenario, B&M’s sales of essential goods act as a floor, and it can gain new customers from higher-priced competitors. However, B&M’s pricing power in the traditional sense (ability to raise prices without hurting demand) is limited due to its positioning – it competes on having the lowest price, so it generally avoids raising prices unless cost inflation necessitates it. Instead, B&M preserves margins through cost efficiency and by smart buying (passing on cost increases selectively or offsetting them with vendor deals). The company’s ability to maintain gross margins in FY24 despite heavy inflation indicates deft pricing and sourcing management. Furthermore, B&M has some flexibility in its mix: it can emphasize higher-margin discretionary items when consumer sentiment is better, and pivot to more basics or smaller pack sizes when wallets are tight, effectively letting customers “trade down” within its stores. This flexibility is a form of pricing power – B&M can adjust its value offering to keep price-sensitive shoppers spending. In sum, demand for B&M’s mix of low-priced essentials and bargains has proven fairly inelastic and resilient, giving the company confidence in continued growth even amid economic uncertainty. As the Chair noted, “B&M thrives even in the challenging trading environment currently prevalent,” and a tough environment can even benefit it by freeing up retail space (lower rents) and pushing more consumers to seek value.

3. Financial Stability

Financial health overview: B&M is in a strong financial position, characterized by solid profitability, robust cash generation, and moderate leverage. In the latest reported fiscal year (FY2024, year ended March 2024), the group generated £5.48 billion in revenue and an adjusted operating profit of £614 million, a 10.9% increase from the prior year. This corresponds to an operating margin of roughly 11%. Net income was £367 million (EPS 36.5p) in FY2024. These figures reflect healthy performance given the economic backdrop – notably, B&M expanded sales and profit despite inflationary pressures, thanks to a 3.7% like-for-like growth in the core UK business and new store contributions. Over a multi-year view, B&M’s financial trajectory has been impressive: Adjusted EBITDA (pre-IFRS16) grew from £342m in FY20 (pre-pandemic) to £629m in FY24, an 84% increase. The company describes this as a “step change” in scale post-pandemic. Even more telling, cumulative operating cash flow over FY21–FY24 was £3.3 billion, of which B&M returned £1.8 billion to shareholders in the form of dividends. This indicates that the business consistently generates surplus cash far above its growth investment needs – a hallmark of strong financial stability.

At the operational level, B&M is highly cash generative. In FY2024, cash flow from operations was £862 million, reflecting efficient working capital management (inventory levels were flat year-on-year despite higher sales). Post-tax free cash flow (after capital expenditures, tax, and lease payments) was reported at £382 million for FY2024. This was a decline from an unusually high £464m in FY2023, mainly due to higher tax payments and an uptick in capital expenditure for new stores, but it still represents a strong free cash yield. In fact, B&M paid out £348m in dividends during FY2024 (including a £201m special dividend) while keeping leverage roughly constant, demonstrating confidence in its cash resiliency.

Importantly, B&M’s sales mix and discount positioning give it defensive qualities in downturns. Management notes that the large contribution of essential goods in the sales mix has helped keep the business “insulated from downturns in consumer spending”. For example, during the second half of 2022 when UK consumer confidence wavered, B&M still delivered positive like-for-like growth by capturing trade-down customers. The company’s ability to sustain growth through the pandemic and the recent inflation shock underscores its resilience. It also tends to carry relatively low inventories (turning stock quickly), which reduces risk of markdown write-downs in a sudden demand drop. Additionally, by not offering credit to customers (all sales are cash or card), B&M avoids consumer credit risk and complicated receivables – a potential advantage in volatile markets.

Balance sheet strength: B&M maintains a reasonably strong balance sheet with a prudent level of debt. As of March 2024, the company had net debt (excluding lease liabilities) of £737 million. This corresponds to a net debt/EBITDA ratio of 1.2×, slightly improved from 1.3× a year prior and comfortably within what is considered a low-to-moderate leverage range. Including lease obligations (from store leases capitalized under IFRS 16), net debt was £2.094 billion, about 2.4× EBITDA, which still represents moderate leverage for a retailer with stable cash flows (and this ratio actually decreased from 2.5× in FY23). The gross debt was about £919 million, offset by £182 million of cash on hand. This cash position, along with undrawn credit facilities, provides liquidity headroom for the business to withstand shocks or seize opportunities.

B&M’s interest coverage and solvency metrics are solid. In FY2024, adjusted net finance charges were £44 million (excluding lease interest). With £614m operating profit, interest coverage on that basis was over 13× – indicating no strain in servicing debt. Even factoring lease interest (£69m) the fixed-charge cover remains healthy at ~5×. The debt has a staggered maturity profile (detailed in Section 6) with only a small portion due in the near term, reducing refinancing risk. B&M has also hedged financial risks where appropriate – for instance, it used interest rate swaps when issuing new debt to lock in rates, and it routinely hedges foreign exchange for inventory purchases to mitigate currency volatility. These actions show a conservative approach to financial risk management, further contributing to stability.

In terms of resilience to downturns and volatility, B&M appears well-equipped. The company’s low-cost structure provides a cushion – it can remain profitable even if sales growth slows, by flexing variable costs. In a severe downturn scenario, management has plans to tighten spending: for example, in its viability stress tests, B&M considered actions like “limiting capital expenditure to essential maintenance only and suspending new store openings” to conserve cash. Because a large portion of B&M’s growth capex and dividends are discretionary, the company has the ability to temporarily curtail these outflows to preserve cash during an economic crisis. This flexibility, combined with its consistent underlying cash generation, means B&M could deleverage quickly if needed (by simply retaining cash instead of paying specials). The business model itself – discount retail – tends to be counter-cyclical or at least defensive, as discussed. Consumers still need basic goods in any economy, and many actually turn to B&M in tougher times, helping offset potential declines in discretionary categories. This was evidenced by the fact that even when UK like-for-like sales turned slightly negative in mid-2024 amid weak consumer confidence, B&M still managed to grow total revenue and maintain profit guidance by year-end. The company did issue a mild profit warning in early 2025 citing an “uncertain economic outlook” and FX volatility impacting valuations of stock (a non-cash accounting item), but the revised EBITDA range (£605–625m for FY25) still implies stable earnings year-on-year and modest growth. This ability to absorb macro volatility with only minor forecast tweaks highlights B&M’s resilience.

Overall, B&M’s financial stability is reflected in its investment-grade-like credit metrics (low leverage, strong coverage), abundant liquidity, and the fact that it can continue funding growth and dividends even in choppy economic waters. The company’s long-term capital allocation framework (in place since 2016) prioritizes maintaining a sound balance sheet while returning excess cash – and so far B&M has struck that balance well. Absent a drastic downturn, the business has ample headroom to finance its expansion plans (which require relatively low capex) and meet all financial obligations comfortably. In the event of an extreme scenario, B&M’s defensive qualities and management’s demonstrated discipline in cost and capital management provide assurance of its stability.

4. Management Quality

Leadership team and track record: B&M’s management is regarded as experienced and execution-focused, with a strong track record of value creation. The company was led for nearly two decades by CEO Simon Arora, who (with his family) acquired the business in 2004 and grew it from a regional chain into a national powerhouse before taking it public in 2014. Under Arora’s stewardship, B&M delivered exceptional growth and shareholder returns, establishing the formula of tight cost control and aggressive store expansion. Simon Arora retired as CEO in September 2022, handing over the reins to Alex Russo. Russo had joined B&M in 2020 as CFO and was instrumental in steering the company through the pandemic period. As CEO from 2022 to 2025, Alex Russo continued to drive the strategy successfully – during his tenure, group revenues grew ~50% and the company distributed over £2.0 billion to shareholders in dividends (including specials). He also oversaw an acceleration of store openings (particularly returning to pre-Covid rates in the UK) and the effective integration of the Wilko store acquisitions in late 2023. Russo’s background includes senior roles at major retailers (he was formerly CFO of ASDA Walmart in the UK), and he is credited with maintaining B&M’s entrepreneurial, results-oriented culture post-Arora. In February 2025, Russo announced he would retire as CEO effective 30 April 2025. While this transition raised some investor concerns (B&M’s share price dipped on the news, hitting its lowest level since 2022), analysts noted that Russo’s departure was “of limited surprise” and likely part of a planned succession process.

The Board moved quickly to address succession: a search for a new CEO was already in advanced stages with a leading executive search firm, and the company indicated it would announce Russo’s successor in due course. This proactive approach suggests robust succession planning and governance at the board level. It’s worth highlighting that Bobby Arora (Simon’s brother and co-owner) remains with the business as an executive director overseeing buying/merchandising, which provides continuity in the company’s trading expertise. The Arora family retains roughly a 4.2% ownership stake in B&M through SSA Investments S.à r.l., aligning their interests with shareholders and ensuring the founders’ perspective is still present to some degree.

B&M’s board of directors is composed of a non-executive Chair and a majority of independent non-executive directors, alongside two executive directors (the CEO and CFO). The board has undergone renewal in recent years: long-time Chairman Peter Bamford (appointed 2018) retired in July 2024 and was succeeded as Chair by Tiffany Hall, an independent director who had been on the board since 2018. Tiffany Hall brings extensive consumer industry experience and had served as Senior Independent Director; her appointment to Chair was welcomed as she has deep knowledge of B&M’s strategy. The CFO, Mike Schmidt, joined in late 2022 and has a background as CFO of DFS Furniture plc and a prior career in investment banking. This mix of retail veterans and financial expertise in the top team has so far worked well.

The management team is widely seen as highly competent operators. They have demonstrated skill in cost management (e.g. adapting to inflation without eroding margins), nimbleness in merchandising (e.g. swiftly adjusting product mix to meet demand trends), and disciplined capital allocation. A testament to management quality is B&M’s industry-leading profitability metrics and returns on capital, which are the product of careful execution. Furthermore, management navigated significant challenges (Brexit, Covid supply disruptions, inflation surges) effectively – for example, ensuring the supply chain kept flowing during global logistics snarls, and turning potential inventory gluts into record sales by smart markdown management. The leadership also proved adept at governance and compliance, balancing the requirements of being Luxembourg-incorporated with London listing rules. The Annual Report shows a strong emphasis on governance best practices (independent committees, rigorous risk management, etc.), and no major governance controversies have surfaced. One point to note is that the Arora family had various related-party dealings (e.g. they own some property leased to B&M), but these have been transparently disclosed and managed via a relationship agreement, and with Simon Arora no longer on the board after 2023, potential conflicts have further reduced.

Management incentives and alignment with shareholders: B&M’s leadership is strongly incentivized to drive shareholder value. The company’s remuneration structure includes annual bonuses and long-term incentive plans (LTIP) tied to performance metrics. For the 2021-2024 LTIP cycle, the performance conditions were split 50/50 between adjusted EPS growth and relative total shareholder return (TSR) versus other retail companies. This ensured that management’s rewards depended on delivering profitable growth and stock performance in line with peers. The targets set were ambitious – e.g. an EPS range of 37p to 45p for that LTIP, which had to be adjusted upward when the UK corporate tax rate increased. For the new 2024 LTIP awards, the CEO’s opportunity was 250% of salary (200% for CFO), again based on EPS and TSR criteria. These incentives align management with shareholders’ interests in earnings expansion and market outperformance. B&M’s remuneration committee has also increased shareholding guidelines (the CEO is expected to build up a holding worth 250% of salary), further promoting alignment.

Notably, B&M’s leadership has not hesitated to invest their own money in the company’s stock, especially when they perceive value. In February 2025, after a dip in the share price, two top board members bought shares on the open market – Chair Tiffany Hall purchased ~70,000 shares at £2.87 ( ~£201k worth), and Senior Independent Director Oliver Tant bought 7,500 shares at £2.85. Such insider purchases signal confidence in the company’s prospects and alignment with shareholder interests. The Arora family’s remaining stake, while smaller than at IPO (they have sold down over time), still makes them significant shareholders who care about long-term value. Overall, management’s interests appear well-aligned with shareholders through ownership, transparent incentives, and a record of substantial cash returns (dividends) to investors.

Capital allocation and cost control: B&M’s management has followed a shareholder-friendly capital allocation strategythat prioritizes high-return investments and returning excess cash. In 2016, the board set out a formal capital allocation policy to guide these decisions. The results are evident: the company targets a 30–40% payout of net income as an ordinary dividend (providing a baseline yield to shareholders), and then it has regularly distributed additional cash via special dividends when leverage is below target or cash generation outpaces expansion needs. For example, in the four years FY21–FY24, B&M paid out £1.8 billion in aggregate – a combination of regular dividends and multiple specials – funded by its surplus free cash flow. In February 2024 it paid a 20p special dividend (c. £201m), and again in February 2025 declared a 15p special (£151m) as excess cash was available. Management has shown discipline in not hoarding cash or pursuing empire-building acquisitions; instead, they return it to shareholders unless it can be deployed at high returns internally. This discipline extends to M&A – B&M’s deals (Heron Foods, Babou, and Wilko stores) have all been relatively small, focused, and highly accretive. There has been no evidence of management overpaying for growth or straying outside their circle of competence.

At the same time, management aggressively invests in high-ROI projects: new store openings are funded as long as they meet payback hurdles (which are very short, under 12 months in many cases). They also invest in infrastructure where needed – e.g. building a large southern distribution center in 2020 to support store growth – but only with a clear view to efficiency gains. Notably, the company has avoided costly experiments such as developing a full e-commerce platform or international expansions beyond its expertise. This focus keeps capital allocation effective and returns high.

Cost control is culturally ingrained in B&M, and management has proven exceptional at cost management. From store operations (labor scheduling, shrinkage control) to head office costs (they run a relatively small central team for a retailer of its size), B&M is run with a tight belt. During FY2023–24, when inflation hit input costs and wages, management mitigated impacts through vendor negotiations and internal efficiencies, resulting in only modest SG&A growth and preservation of EBITDA margin. The CEO’s philosophy of “simple systems and processes” means the company avoids unnecessary complexity that can drive up costs. One illustrative metric: B&M’s ratio of operating costs to sales is significantly lower than most traditional retailers, underpinning its ability to maintain ~10%+ operating margins at such low price points. Furthermore, management has shown foresight in cost management by investing in energy-saving initiatives (LED lighting, efficient refrigeration) across stores to reduce utility costs long-term. Even in areas like logistics, B&M has strengthened controls and capacity without letting costs run away (they tightened warehouse management and navigated freight disruptions with minimal extra cost).

In summary, B&M’s management quality is evidenced by: strong leadership succession, a mix of retail know-how and financial acumen on the team, clear alignment with shareholders (via ownership and incentive structures), and a consistent record of value-accretive decisions – from how they expand, to how they handle cash and costs. The pending CEO transition will be a test, but given the bench strength (CFO Mike Schmidt and other senior executives like Trading Director Bobby Arora) and the board’s involvement, there is reason to believe the new CEO will keep B&M on its well-charted course. As Tiffany Hall (Chair) stated, Alex Russo assembled a “high quality leadership team” beneath him and is retiring leaving growing businesses with great potential in both the UK and France. This suggests that continuity plans are in place and the company’s leadership depth will support the next phase of growth without major disruption.

5. Operating Profitability

B&M enjoys robust operating profitability, driven by its high-margin product mix and efficient operations. In a normal year, the company can be expected to deliver operating earnings in the mid-hundreds of millions of pounds and strong free cash flow conversion. For instance, in the most recent normal trading year (FY2024), B&M’s adjusted operating profit was £614 million, equating to an operating margin of ~11.2% on £5.48bn sales. The prior year FY2023 saw £554m operating profit on £4.98bn sales, about 11.1% margin, indicating consistent underlying profitability. These margins are quite healthy for a brick-and-mortar retailer (many general retailers operate in mid-single-digit margins), reflecting B&M’s low cost base and favorable product economics. Approximately half of B&M’s sales are in general merchandise categories, which carry higher markups than pure grocery, boosting blended margins. Moreover, B&M benefits from volume rebates and supplier discounts due to its scale, which support gross margin. The stability of B&M’s operating margin over time – even as it expands and faces input cost swings – underscores that its model is inherently profitable across cycles.

In terms of cash flow, B&M converts a large portion of its earnings into free cash flow (FCF), thanks to relatively low maintenance capex and efficient working capital. In a normal year, free cash flow after tax tends to be on the order of hundreds of millions. For example, post-tax FCF was £382m in FY2024 and £464m in FY2023. The FY2023 figure was exceptionally high (partly boosted by working capital release as supply chains normalized), while FY2024’s £382m reflected a step-up in growth investments and the higher UK tax rate. Going forward, with corporation tax now at 25% (versus 19% previously) and continued store expansion, annual FCF might settle somewhat lower than the FY2023 peak, but should remain strong – likely in the £300–400+ million range annually, assuming mid-single-digit revenue growth and stable margins. This is supported by the fact that maintenance capital expenditure is small relative to EBITDA (discussed in Section 8) and B&M’s working capital is well-managed (inventory turns are high and the business enjoys some trade credit from suppliers). In short, B&M’s operating model produces ample free cash flow in excess of its growth needs, enabling the firm to both invest and return cash concurrently.

It is important when evaluating operating profit to consider any adjustments and non-cash items. B&M reports “adjusted” profit metrics which exclude certain one-off or non-trading items for better period-to-period comparability. In recent years, these adjustments have been minor – for instance, in FY2024 the difference between statutory operating profit (£608m) and adjusted (£614m) was only £6m, mainly due to one-time costs/income. This implies the quality of earnings is high, with minimal distortion from unusual items.

One specific non-cash expense is stock-based compensation (SBC), which B&M accounts for as a part of administrative costs. The share-based payment expense was £3 million in FY2024 (same as FY2023). This is a relatively negligible amount (<0.5% of operating profit), so SBC does not materially impact B&M’s reported profitability. Even so, when calculating underlying free cash flow, one might add back that £3m since it’s non-cash – but it’s so small that free cash flow is essentially the same with or without that adjustment. The low level of SBC reflects that, while management is incentivized with shares (as described earlier), the company’s equity grants are not overly dilutive or expensive.

Operating earnings outlook: Based on guidance and recent performance, B&M’s operating profit is expected to remain around the FY2024 level in the near term. The company updated its FY2025 guidance to an adjusted EBITDA (pre-IFRS16) of £605–625 million. This range is roughly flat to FY2024’s £629m EBITDA, indicating stable operating profit once we account for slightly higher depreciation on new assets. The guidance was trimmed marginally due to cautious views on the economy and some exchange rate volatility affecting cost of goods, but essentially suggests B&M anticipates sustaining its current earnings power. Over the medium term, as new stores mature and if like-for-like sales give even modest growth, operating profits should climb. B&M itself states it is set for “many years of compounding earnings growth” through its four channels (existing stores, new UK stores, France, and Heron). In a normalized scenario (absent any macro shock), it would not be surprising for B&M to grow EBIT by mid-single digits annually, given planned space growth of ~5-6% and some operational leverage. Furthermore, any improvement in the French segment’s margins (currently a bit dilutive but expected to improve long-term) would contribute to consolidated operating profit expansion.

When comparing operating earnings to free cash flow, it’s worth noting B&M’s cash conversion is excellent. In FY2024, for example, out of £614m adjusted operating profit, the post-tax free cash flow was £382m – after investing £124m in capex and paying £131m in cash taxes. This implies roughly 85-90% of operating profit translated to free cash (when adding back growth capex, which we could consider discretionary, the underlying cash generation was even higher). B&M’s asset-light model(leasing stores instead of owning, keeping capex low per store) is a big factor in this high cash conversion.

Stock-based compensation and necessary adjustments: As mentioned, stock-based comp is very low for B&M (around £3m p.a.), so adjusting for it would hardly change the profit or cash flow picture. B&M’s adjusted metrics already exclude any one-off costs like refinancing charges or gains. For instance, in FY2024 the company refinanced some bonds and recorded a £5m accounting gain on bond redemption – such items are stripped out of “adjusted” profit to focus on the ongoing performance. There have been no large restructuring costs or impairments in recent years that would require analyst adjustments. Therefore, an investor analyzing B&M’s operating profitability can be confident that the reported adjusted EBITDA (£629m in FY24) and adjusted EBIT (£614m) are a fair reflection of the cash-earning power of the business. If anything, one might consider an adjustment for lease expenses: under IFRS16, B&M’s operating profit is after removing £(180)m of rent expense and adding £(69)m of lease depreciation and £(69)m interest (FY24 figures). Many analysts will look at EBITDA pre-IFRS16 (which was £629m in FY24) and compare that to cash rent paid (approx. £180m) to gauge true operating profitability. B&M provides those pre-IFRS16 numbers for transparency, and on that basis the EBITDAR margin is about 11.5% and rent is about 3-4% of sales – indicating that even including rent, operating margins are solid.

In conclusion, B&M’s operating profitability is strong and well-managed. In a steady state “normal” environment, the company can generate on the order of £600m in operating profit and £350-400m in free cash flow annually (after fueling its growth), barring significant macroeconomic swings. The impact of stock-based compensation on these figures is minimal, and no major adjustments are needed to understand the true earnings – the reported numbers are largely “clean.” This profitability, combined with relatively low capital intensity, is what allows B&M to fund expansion, service debt, and pay shareholders – a balance it has executed adeptly in recent years.

6. Debt Structure

B&M’s debt structure is straightforward and has been managed conservatively to avoid repayment cliffs or excessive interest burden. The company employs a mix of bank debt and senior secured bonds, with staggered maturities extending into 2030. As of the latest reports, the key components of B&M’s gross debt (approximately £919 million total) are:

Term Loan and Revolving Credit Facility (RCF): B&M has a secured term loan from banks, and an accompanying revolving credit facility, which together provide flexible bank financing. At March 2024, the term loan outstanding was £221 million. The combined term loan/RCF facility was recently extended by one year to mature in March 2029. The total committed facility size is around £450 million, giving B&M ample liquidity headroom (the unused portion acts as a back-up credit line). The interest on this debt is floating (tied to SONIA or similar) plus a margin. In FY2024, as interest rates rose, B&M’s net finance costs (ex-IFRS16) increased to £44m from £38m) – reflecting higher rates on the new debt facilities after refinancing. Even so, the overall effective interest rate remains reasonable (roughly 5% or below on average debt). B&M’s strong cash generation means it could pay down the term loan quickly if desired, but it chooses to maintain some bank debt to optimize capital structure.

High-Yield Bonds: B&M has issued three tranches of senior secured notes (often called high-yield bonds) to lock in long-term funding at fixed rates:

A bond of £400 million (2020 issue) was partially refinanced in late 2023. In November 2023, B&M redeemed £244m of this bond early (at 98% of par), resulting in a £5m gain, and left £156 million remaining outstanding from this series. The £156m bond matures in July 2025. Management has stated they foresee no issues refinancing or repaying this small remainder when due – given the company’s cash on hand and credit access, the July 2025 maturity is not a concern.

A £250 million bond due 2028. This was issued in 2021 (with a 7-year tenor). Although the exact coupon isn’t quoted in the provided docs, typical pricing at that time for B&M was around 3.625%–4% interest. This note matures in November 2028.

A £250 million bond due 2030, issued in November 2023 as part of the refinancing. This new bond carries an 8.125% coupon (reflecting higher interest rates by 2023) and matures in November 2030. B&M executed an interest rate swap to hedge the rate prior to issuance, mitigating some interest cost risk.

These bonds are senior secured (secured against assets of the group alongside the bank debt) and are likely rated in the high BB or low BBB range (given B&M’s credit profile). They have standard covenants and, importantly, no financial maintenance covenants on the bonds. The bond financing gives B&M long-term certainty of funding. After the refinancing actions, B&M now has a smooth maturity ladder: only £156m is due in mid-2025, then nothing major until late 2028, then 2030. This structure avoids any near-term liquidity crunch. The company indicated confidence that it can refinance the 2025 bond “on acceptable terms” when needed, but even if credit markets are unfavorable, B&M could potentially pay it off from internal cash generation over the next year.

Other Loans: There are small local facilities, such as B&M France loan facilities (~£10 million outstanding) and possibly minor finance leases or overdrafts, but these are immaterial in the context of the overall debt.

In total, the gross debt of ~£919m at FY24 comprised roughly £650m in bonds (the two £250m notes plus the £150m stub) and ~£269m in bank debt (term loan plus a small draw on RCF or other loans). Net debt was £737m after £182m cash offset.

Interest obligations: With the new 2030 bond at 8.125% and assuming the 2028 bond coupon is around mid-3%s, and the term loan/RCF being floating (currently high single-digit rate given base rates), B&M’s interest costs will tick up somewhat in FY25 vs FY24. In FY24, cash interest paid on borrowings was £41m (excluding lease interest). Going forward, if we estimate: £156m bond at ~4%, £250m bond at ~4%, £250m bond at 8.125%, and ~£220m term debt at maybe ~6%, the interest sum would be around £50–55m annually. This is comfortably covered by EBITDA (interest cover >10x). It is also a relatively small percentage of operating cash flow (6–7%), so the debt service does not strain the business. B&M’s decision to carry some debt (instead of being net-cash) is logical given this low relative cost and the tax deductibility of interest (especially now with higher UK tax rate, interest shields are more valuable).

Financial strategy and leverage policy: B&M’s management has indicated a target leverage range historically around 2.25× net debt/EBITDA including leases (which equates to ~1.25× excluding leases) as a comfortable level, though not a hard target in public statements. At 1.2× (ex-leases) currently, leverage is at the low end of a typical range for a leveraged retailer. This gives B&M flexibility to add debt for strategic uses if needed or to withstand EBITDA declines. The company’s actions – refinancing early and extending maturities – show a proactive approach to debt management. In November 2023, refinancing part of the 2025 bond seven months ahead of maturity and pushing out to 2030 at a fixed rate removed uncertainty and took advantage of the company’s strong credit standing. Management even absorbed a slightly higher coupon to lock in long-term funding, which can be seen as prioritizing stability over trying to minimize short-term interest costs.

B&M also balances debt with returning cash: it paid a large special dividend in Feb 2024 even as it was refinancing debt, essentially leveraging up slightly to distribute excess cash (net debt rose by £13m YoY). This indicates that the board is comfortable with the current leverage and does not seek to deleverage further; they would rather shareholders have the cash. The dividend policy of paying 30-40% of earnings and distributing extra via specials will likely persist as long as net debt/EBITDA stays in the low 1× range and there are no large investment needs.

The absence of restrictive covenants on bonds means B&M has financial flexibility. The bank facilities likely have standard leverage and interest cover covenants, but at present levels B&M has ample headroom on those. In the viability assessment, the board even considered severe scenarios and concluded the company would still meet obligations, noting it had “significant headroom on covenants” and could handle stress tests comfortably.

One notable strategic consideration is that B&M is contemplating redomiciling the parent company from Luxembourg to either Jersey or Ireland. While this doesn’t directly change the operational debt, it may simplify certain regulatory and tax aspects (e.g. likely eliminating Luxembourg withholding tax on interest or dividends). The company stated it intends to retain its London listing regardless. From a debt perspective, moving to Jersey (a UK Crown Dependency) might be neutral or positive, as many bond investors are comfortable with Jersey domiciles and it could reduce administrative costs. It’s unlikely to affect debt covenants materially.

In summary, B&M’s debt structure is well-structured and not excessive. The company has spread out its maturities (2025, 2028, 2030, 2029 for the bank debt), has a mix of fixed and floating rates (providing both certainty and flexibility), and maintains a moderate leverage ratio. B&M’s strong interest coverage, proven access to capital markets, and capacity to deleverage if needed (by cutting discretionary outlays) all indicate that its debt load is very manageable. The long-term strategy appears to be maintaining a relatively stable leverage ratio while the business grows – meaning absolute debt may increase slowly with EBITDA, but the company doesn’t intend to swing to high leverage. The board’s willingness to refinance early and even incur a small premium to retire debt early reflects a prudent approach to keeping the debt profile healthy. Stakeholders (both equity and bondholders) can thus be confident that B&M is unlikely to face financial distress from its debt; on the contrary, it uses debt judiciously to enhance equity returns (via special dividends and growth funding) without compromising solvency.

7. Taxes

B&M’s tax situation is influenced by its international structure and changes in tax law, but it generally incurs taxes at rates close to the standard corporate rates in its operating markets. The company is incorporated in Luxembourg, but the vast majority of its profits are earned in the UK (and to a lesser extent France), so those profits are taxed primarily under UK (and French) tax rules with Luxembourg largely being a holding jurisdiction.

Official vs effective tax rates: The UK raised its corporation tax rate from 19% to 25% effective 1 April 2023, which has directly impacted B&M’s tax expense. In FY2024, B&M’s total tax charge was £131 million, up from £88m the prior year, “primarily reflecting” the rate increase to 25% as well as growth in profit. The effective tax rate on statutory profit before tax (£498m) works out to about 26.3%. This is slightly above the new 25% UK headline rate, due to some non-deductible expenses and prior year adjustments. The breakdown in the accounts shows an expected tax of £124m at the standard rate, plus £6m of disallowed expenses (e.g., certain depreciation, business expenses not deductible) and minus £1m of non-taxable income, arriving at ~£131m. So B&M’s effective tax rate is roughly in line with the statutory rate, with minor variances. In Luxembourg, there is likely minimal taxable profit because the operating activities are elsewhere (Luxembourg’s role may just be as a holding entity). Similarly, in France the statutory corporate tax is around 25%, and B&M’s French operations would pay tax on their profit at that rate (France has actually reduced its corporate tax to 25% as of 2022, aligning with the UK’s new rate). B&M’s overall consolidated effective rate will be a weighted average of UK 25% on UK profits and French 25% on French profits, which ends up ~26% when some permanent differences are included, as seen.

One nuance: as a Luxembourg company, B&M historically had to withhold Luxembourg tax on dividends paid to shareholders. Luxembourg’s standard dividend withholding tax is 15%. However, many institutional shareholders may get that reduced via treaties or refunds. The company quotes dividends “gross before deduction of Luxembourg withholding” in its reports, indicating that there is indeed a withholding tax applied. This was likely an irritant to some shareholders. The proposed redomiciliation to Jersey or Ireland could be partly to eliminate this issue – Jersey, for instance, has 0% withholding tax on dividends and no corporation tax for non-financial companies, which would make dividend payments simpler and potentially increase net returns to shareholders in certain cases. Ireland’s 12.5% corporate tax is lower than 25%, but if B&M moved to Ireland it would likely still pay UK tax on UK profits (since it has a permanent establishment in the UK). Jersey being outside the UK and EU could provide a neutral holding location with light regulation.

Expected changes in taxation: The big change – the UK tax rate jump to 25% – has already taken effect and was reflected in FY24 numbers (the tax charge rose accordingly). For FY2025 and onward, the expectation is B&M’s effective tax rate will be around 25-26%, absent further changes. There are no announced plans for the UK to change its rate again in the immediate future (25% is likely to stay for the medium term, though political changes could always alter that). France is stable at 25%. Luxembourg’s effective tax for the holding company might be near zero (Luxco might just break even if it only receives dividends and pays them out).

Tax strategy and compliance: B&M appears to be compliant and not aggressive in tax planning. The fact that they are considering moving domicile to Jersey or Ireland might raise questions if it’s tax-driven, but it’s likely equally about administrative simplicity (Luxembourg has some redundant requirements post-Brexit) and shareholder convenience (as noted, removing Lux withholding tax). B&M’s accounts mention compliance with anti-tax evasion laws and that they seek to manage taxes but within the law. They haven’t been reported to have any disputes with tax authorities or any large uncertain tax provisions. The overall tax contribution is significant and set to increase proportionally with profit due to the higher rates.

8. Capital Expenditures

B&M’s capital expenditure (capex) requirements are relatively modest for a retailer of its size, thanks to its asset-light strategy (leasing stores rather than owning the real estate) and its efficient new store model. The company’s capex can be thought of in two buckets: maintenance capex needed to sustain the existing business, and growth capex for new store openings and expansion initiatives.

Maintenance capex: This includes routine expenditures such as store refurbishments, replacement of fixtures/fittings, IT systems upgrades, and upkeep of distribution centers. B&M has stated that it prioritizes keeping existing infrastructure appropriately invested, but without over-spending. In FY2024, B&M’s net capex was £124 million. Out of this, approximately £65 million can be inferred as maintenance or non-expansion capex. This inference comes from the disclosure that £59 million was spent on 78 gross new store openings during the year, implying the remainder of the £124m was on existing assets. For context, £124m capex is only ~2.3% of sales, which is quite low. Stripping out growth, maintenance capex is roughly 1.2% of revenue. This indicates that the core business does not require heavy ongoing investment – the store formats are simple and don’t need frequent costly remodels (unlike, say, fashion retailers that change layouts often). Many B&M stores operate for years with minimal refresh, aside from occasional paint, shelving replacements, or lighting upgrades. The distribution centers are another area of maintenance capex; B&M has five DCs (including one large one opened in 2020), which may need equipment updates or expansions periodically, but those have been manageable (in FY2023, maintenance including distribution was £40m).

Given the above, one can estimate B&M’s maintenance capex (to keep sales and operations at current levels) is on the order of £50–70 million per year. This is relatively low compared to annual depreciation (which was £125m excluding leases in FY24, per cash flow note) – indicating some of depreciation relates to assets from prior expansion, but in cash terms maintenance needs are lower. In a downturn, B&M can also defer non-essential maintenance for short periods; the board even noted in stress testing that they could limit capex to essential maintenance only, which suggests the truly essential maintenance is quite minimal (possibly just safety or critical systems). However, B&M generally keeps its stores in decent shape for customers, so it will spend what’s needed to ensure good standards (they pride themselves on “excellent in-store operational standards” which would include a clean, well-maintained environment).

Growth capex: B&M’s growth investment primarily goes into new store openings. Because B&M leases its store premises, the capex for a new store is mostly fit-out costs (shelving, checkout counters, lighting, signage, etc.), IT and initial stocking costs (though initial inventory is working capital rather than capex). The company has been opening new stores at a rapid clip: in FY2024, it opened 47 net new B&M UK stores, 11 B&M France stores, and 20 Heron Foods stores (78 gross, with a few relocations/closures netted off). For that, it spent £59m in capex, which implies an average cost per new store of around £0.76m. This low cost per store is a testament to B&M’s efficient rollout – they often take over existing retail shells (like ex-grocery or DIY stores) that require only moderate refitting. Importantly, many new B&M stores involve adding a garden center section or other enhancements, but even those are done cost-effectively. The payback period of <1 year on new stores means each store likely generates roughly £1m+ EBITDA in its first full year, for a capital outlay of £0.7-0.8m – an excellent return.

Looking ahead, B&M plans to continue expanding: in FY2025 management guided to ~73 gross new stores across the group (45 in UK B&M, 11 in France, 17 Heron). They also indicated a plan for 45 new B&M UK stores per year for at least the next three years (FY25–FY27), and they raised their long-term UK store target to at least 1,200 stores (from ~800 previously). This implies about 450 more B&M stores in the UK over a decade (a ~60% increase). In France, they signaled intentions to “gently increase” the opening rate – currently ~10-15 per year – which could ramp up as they build more brand awareness. Heron Foods is opening ~20 stores per year now, but could accelerate in the long run toward a much higher potential store count if the model continues working.

In terms of capex usage, if B&M opens on the order of 70-80 stores per year as a group, we can expect growth capex in the ballpark of £60-80 million per year (at ~£0.8m each). Additionally, there may be some growth capex for other purposes: for example, B&M occasionally buys the freehold of a property if opportune (in FY2023 they spent net £4m on one freehold acquisition). They also invest in strategic projects like distribution capacity expansion or major IT upgrades from time to time. However, no major new distribution center is immediately needed since the last one in Bedford opened in 2020 adding 1 million sq ft capacity, which should support a lot of store growth. Perhaps toward the latter half of this decade, if approaching 1,200 UK stores, B&M might invest in another warehouse or automation systems – but those would be planned well in advance.

One growth-related investment mentioned in the annual report is store replacements/upgrades: B&M is actively relocating some older smaller stores to newer larger sites (often adding a garden center in the process). In FY24, 5 such replacement stores were opened. These count in the gross openings and presumably are included in the capex spend. Replacing old stores with bigger ones yields higher sales density and is part of the growth strategy, albeit with some incremental capex. The company noted that replacing an older store with a new one typically more than doubles the space, thus boosting sales. This is a smart use of capital where leases expire – rather than just renew a small store, they invest to upgrade to a larger format.

Another aspect of capex is ESG and efficiency initiatives. B&M disclosed plans to invest in energy-efficient technologies, like rolling out LED lighting (already done in B&M France stores, cutting energy use by 70% there) and other carbon-reducing measures. They acknowledge this “will increase capital expenditure costs in the short to medium term”, though not dramatically. For instance, they set aside £1m for solar panel projects at Heron Foods in FY25. Such expenditures are relatively minor and fall under maintenance or improvement capex. They tend to have multi-year paybacks (18 months to 4 years for some tech like building management systems). Management has already incorporated these into strategic capex projections, so while they’ll add slightly to maintenance capex, they also reduce operating costs (energy bills), and are not large enough to strain cash flow.

Capex sustainability and funding: B&M’s current and planned capex is easily funded by internal cash flows. In FY2024, despite elevated capex (£124m), the company still produced £382m free cash post-capex. If we assume capex even grows to ~£150m in coming years (for more new stores and ESG projects), B&M’s operating cash (north of £800m) can cover that more than five times over. Thus, growth is not capital-constrained. This is why B&M can both expand and pay large dividends simultaneously – the cash payback from new stores is so quick that growth almost “funds itself” after a short lag. The company’s disciplined approach means they are unlikely to undertake a capital expenditure that would jeopardize their dividend or require external funding. Even if they saw an opportunity to open, say, 100 stores in a year (perhaps via an acquisition), their balance sheet could handle a temporary surge by using the RCF or slowing dividend payout. But the current guided pace (45 UK stores/year) is intentional to ensure quality and not overload the organization. Management has emphasized that the quality of openings is paramount over quantity – they won’t strain operations by opening too many at once. This suggests capex will grow in a controlled, predictable manner in line with what the infrastructure (supply chain, management bandwidth) can support.

The timeline for the capital expenditure plans aligns with their store rollout runway. They see at least 10 years of expansion in the UK to reach 1,200 stores, and similarly France “many years of growth” to approach a potential market size similar to the UK. Thus, one can expect growth capex to continue at current levels or higher for a decade or more. This is a positive, as these are high-ROI investments fueling earnings growth. Importantly, if at any point the returns on new stores diminish or the market saturates faster, B&M can throttle back expansion – capex is largely discretionary beyond maintenance. This flexibility adds resilience to their long-term plan.

One more point on sustainment: B&M’s multi-year capital allocation framework explicitly weighs investing in growth vs returning cash. They have consistently found ample opportunities to invest (new stores) at >100% ROI, so they invest that first, then designate the rest for returns. We can thus expect them to continue this balance: fund all promising new stores (the pipeline is strong for next two years, bolstered by Wilko site acquisitions, which “means the store pipeline for the next two years remains strong”, and any leftover cash beyond a target leverage gets returned. The capex plan is very sustainable under this approach – it grows in line with what the business can support and stops when returns would drop.

In conclusion, B&M’s capital expenditure profile is one of relatively low maintenance needs and scalable growth spend. Maintenance capex is modest (~£50-70m/year) to keep stores modern and infrastructure sound, which is easily covered by depreciation and ongoing cash flow. Growth capex, currently around £60m for new stores annually, is expected to continue for many years as B&M marches toward its expansion goals in the UK and France. Even if growth capex rises (with more stores or cost inflation in fit-outs), B&M generates several times that amount in cash from operations, ensuring it can fund expansion internally without debt increases. The company’s plan to open ~45 UK stores per year for the foreseeable future appears highly achievable and sustainable, given each requires under £1m capex and the organization has demonstrated capacity to integrate that many annually (as seen in FY24). In times of economic uncertainty, B&M can dial capex down (focusing only on the highest priority openings or delaying projects) to preserve cash, which adds to financial resilience. However, currently the strategy is full steam ahead on profitable expansion. Thus, investors can view B&M’s capex not as a drag, but as a value-creating deployment of capital, with a long runway of opportunities. The maintenance capex is properly accounted for in their free cash flow guidance, so underlying free cash flow remains strong after keeping the business in good shape.

9. CEO Retirement and Succession Planning

A significant recent development for B&M is the announced retirement of CEO Alex Russo and the ensuing succession process. On 24 February 2025, B&M disclosed that Mr. Russo intends to step down as Group Chief Executive (and Director) effective 30 April 2025. This news is noteworthy as Russo has been at the helm during a successful period and his departure comes after only ~2.5 years in the role (he became CEO in September 2022. Investors understandably pay close attention to CEO transitions, especially in a company that has had relatively stable leadership (only two CEOs in the past 20 years, Russo and prior to him Simon Arora).

Impact of CEO retirement: Alex Russo’s retirement is framed positively by the company – it appears to be a voluntary departure (perhaps for personal reasons; “retire” suggests he’s not immediately jumping to another rival) after accomplishing key objectives. The Chair, Tiffany Hall, thanked Russo for his “commitment, energy, dedication and hard work” and highlighted his achievements. Under Russo’s leadership (which coincided with post-pandemic recovery), B&M expanded its store footprint significantly in both the UK and France and maintained a “relentless focus on high operational standards and low costs,” enabling the company to deliver great value to customers and strong cash returns to shareholders. These remarks emphasize continuity – Russo continued the successful formula – and they reassure stakeholders that B&M’s strategic direction remains intact. Russo himself reflected on the business being “larger and stronger” than when he started, with revenues up ~50% and over £2 billion returned to shareholders during his tenure. This context is important: it indicates Russo is leaving on a high note, with B&M in excellent financial and competitive shape.

Short-term, the announcement came coupled with a slight profit guidance revision (the profit warning mentioned earlier), which together caused a dip in the share price. However, many analysts saw Russo’s exit as unsurprising – possibly because there had been hints he might not stay long-term, or because the Arora family influence still looms and a different type of CEO might be sought for the next growth chapter. Russo was previously CFO; sometimes CFOs-turned-CEO serve a transitional period after a founder’s departure (Simon Arora in this case) to steady the ship, and then hand over to a new leader for expansion. This seems to be playing out at B&M.

Succession planning: B&M’s board appears to have been well-prepared for this eventuality. The company stated that the Board is in “advanced stages” of recruiting a new CEO with the help of a top executive search firm. This suggests they had begun the process even before the public announcement, likely anticipating Russo’s planned retirement. The Board expects to update the market “in due course,” implying an appointment could be made around the time Russo departs or soon after. Potential candidates could include both internal executives and external retail leaders. Internally, the CFO Mike Schmidt is relatively new and more finance-focused; the Arora brothers (Simon and Bobby) have deep merchandising knowledge but Simon has retired and Bobby might not be positioned for CEO; other senior leaders (e.g., trading or operations directors) might be considered. Externally, B&M might attract a seasoned retail CEO with multi-format experience, given the scale and growth prospects (perhaps someone who led a division of a big supermarket or another discount chain). The key will be finding a leader who embraces B&M’s high-efficiency, value-driven culture.

In the interim, if a gap exists between Russo’s exit and a new CEO start date, it’s likely the Chair Tiffany Hall (or another board member) would take on an acting executive role, or the CFO could serve as interim CEO. However, since the search was well underway by February, the gap may be minimal. The Board’s swift action and communication is a positive from a governance perspective – it reduces uncertainty. Additionally, B&M’s strong second-tier management (the “leadership team” Russo assembled provides continuity in day-to-day operations. Each function (buying, retail ops, supply chain, finance) has experienced heads. So, operationally, the business should not miss a beat during the transition.

Future strategy under new CEO: Whoever takes over will inherit a company with a clear growth strategy (the four-channel growth plan) and a healthy balance sheet – in other words, no need for a strategic overhaul. We expect the new CEO to stay the course: continue UK and France expansion, maintain the EDLP model, and perhaps bring fresh ideas on e.g. digital marketing or new categories, but fundamentally B&M’s strategy is successful and likely to be preserved. The Board, including Bobby Arora and the new Chair, will also ensure the core formula remains intact. The new CEO’s mandate will likely be to accelerate profitable growth and possibly oversee B&M’s further internationalization (e.g., pushing the France business to critical mass). The market will watch closely to see if the new leader has a background that complements these goals – for example, someone with international retail experience or expertise in scaling store networks.

Investor confidence and insider sentiment: It’s noteworthy that following the profit warning and CEO news in Feb 2025, we saw insider buying by the Chair and SID as mentioned earlier. This indicates that those with the most insight into the succession process (the Chair, especially, who is leading the CEO search) are confident in B&M’s future and perhaps in the candidates being considered. It sends a signal that the leadership transition is being handled from a position of strength, not desperation.

CEO retirement in context of Arora family influence: B&M’s journey has been closely tied to the Arora family, and Simon Arora’s exit in 2022 was a big change. The company navigated that well by having Russo (with substantial retail experience) step in. Now with Russo leaving, the Aroras are somewhat more in the background (Simon completely out, Bobby in a non-CEO role). This opens an opportunity for truly independent leadership or perhaps another professional manager to step in. The Board composition (with Tiffany Hall as an independent Chair) suggests that corporate governance has matured beyond founder-centric management. That likely gives comfort to institutional investors that the succession will be based on merit and strategy fit.

Succession planning quality: It appears B&M has handled succession about as well as could be expected: the prior CEO gave a long notice (he announced retirement 2+ months ahead of leaving, and presumably told the Board even earlier), and the Board immediately reassured with a plan and updated guidance to avoid uncertainty. This kind of transparency is a hallmark of good governance. It’s also beneficial that Russo is staying through the fiscal year-end and results announcement (April 2025) to provide continuity through that reporting cycle. We can infer that a new CEO might be in place by mid-2025, allowing overlap or at least a clean start in the new fiscal year (FY26 begins April 2025).

Overall outlook: The CEO transition, while a notable event, is unlikely to derail B&M’s performance. The company’s strategy is well-established and the competitive environment continues to favor discounters. As long as the new CEO (once chosen) clearly communicates commitment to B&M’s winning formula and perhaps articulates how to drive the next leg of growth (e.g., maximizing the 1,200 UK store potential, pushing into new cities in France, or leveraging Heron Foods more), the market should regain confidence. In the short term, there might be some execution risk – any change at the top can lead to shifts in priorities or minor disruptions. However, given B&M’s strong bench and the Board’s oversight, the risk seems contained. The Board explicitly wished Russo well and emphasized the growth opportunities he leaves for the next leadership. Russo himself expressed confidence in the leadership team remaining. Thus, the narrative is that B&M’s success is not one man’s doing, but a function of a solid team and business model.

In conclusion, CEO Alex Russo’s retirement is a managed and planned event, with a capable Board-led succession process underway. B&M’s management quality bench and governance structure mitigate the risk associated with this change. Investors should monitor the appointment of the new CEO and their initial messaging, but can take comfort in the fact that B&M’s strategy has broad consensus support internally and its execution playbook is proven. The company has navigated a similar transition (from founder to first outsider CEO) smoothly, and is well-positioned to handle this next transition. As of now, no change in strategic direction has been signaled – it’s a leadership evolution aimed at supporting B&M’s long-term growth trajectory. In summary, while leadership changes always warrant attention, B&M’s succession planning and strong underlying business suggest that the impact will be minimal and the company will continue to be led by competent, shareholder-aligned management going forward.

10. Valuation Analysis (DCF & IRR)

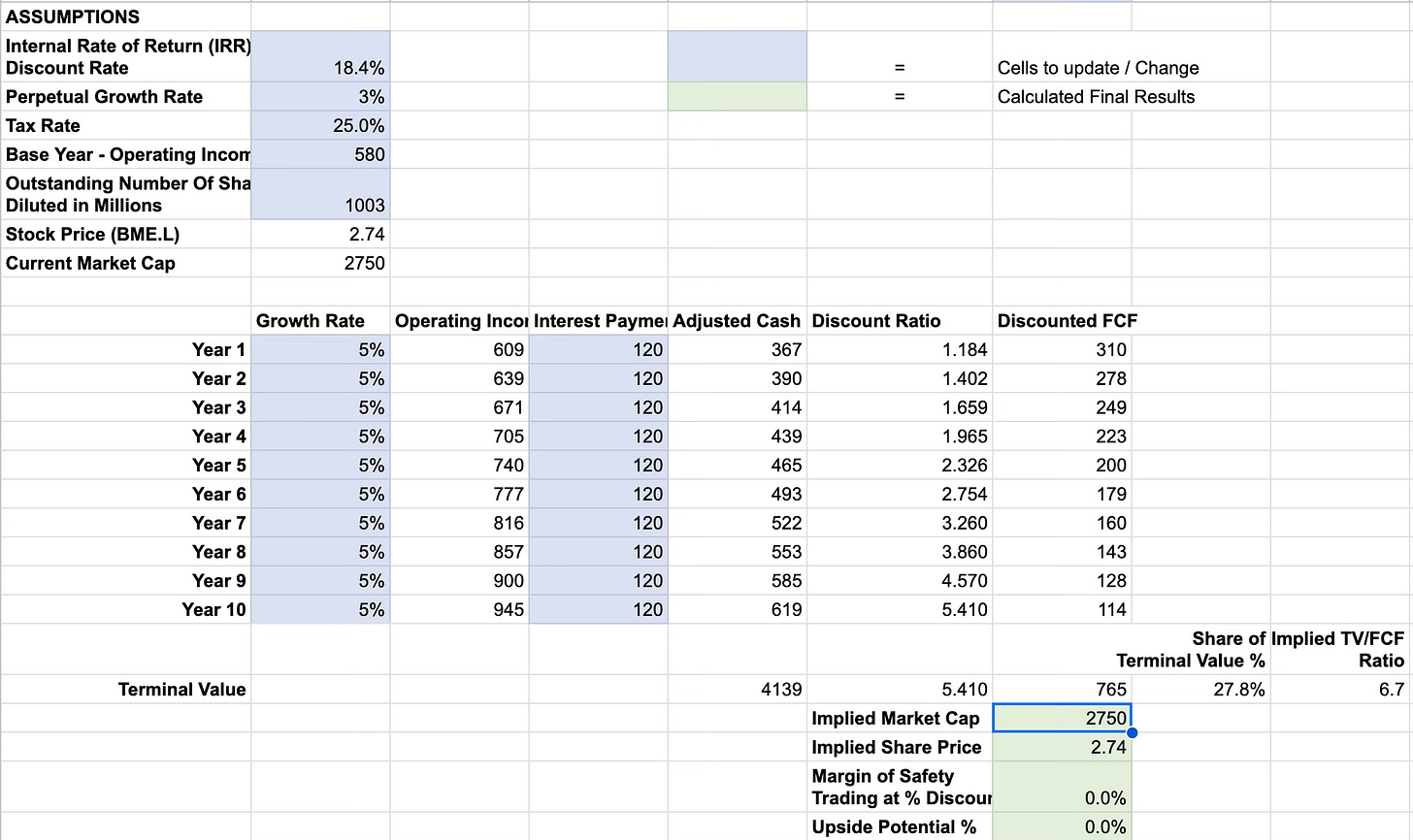

Assumptions

Base year income: £580M

Growth rate: 5% annually for 10 years (conservative estimate—expansion alone drives 4-5% growth, plus 2-3% inflation boost)

Effective tax rate: 25.0%

Annual interest payments (including lease interest): £120M

Methodology & Google Sheets Model

You can read more on the methodology I use here:

IRR at the Current Stock Price

At its current trading price of roughly £2.74, our model indicates an internal rate of return (IRR) of about 18.4%. In other words, this IRR is the annualized rate that aligns the present value of anticipated cash flows with the stock’s current price. If BME.L achieves its projected growth, an investor buying in now could see an annual return in the vicinity of that percentage. It is also worth noting that the terminal value constitutes just 27.8% of the total cash flows, and the implied exit TV/PE multiple is a modest 6.7x - both solid sanity checks.

Discounted Cash Flow (DCF) Valuation & Upside Potential

At an 8% discount rate, the implied price is £9.01, reflecting an upside potential of 228.6%.

At a 12% discount rate, the implied price drops to £4.86, with an upside potential of 77.2%.

At a 15% discount rate, the implied price further declines to £3.58, yielding an upside potential of 30.5%.

💬 What are your thoughts on B&M European Value Retail S.A. (BME.L)’s potential? Share your insights in the comments below! If you found this content engaging, please like, share, and subscribe – your support truly motivates me to keep creating quality content.

Great write up! A potentially naïve question - Why does B&M keep so much debt on the balance sheet? You stated multiple times that it is fairly conservative (5x interest coverage including lease interest), but for a highly cash generative business, what is the benefit? Why not reduce debt? The 8.125% bond for example seems unnecessary? Apologies if this sounds stupid but I have very limited experience in researching retailers!

In your opinion what are the most prominent threats to B&M?

Thanks for the insights!

Brilliant article - thanks for sharing this openly! As a supplier to them I know their procurement is a) frustrating for me b) brilliant for shareholders

Can I ask a question for my education? How do you account for leases in capital expenditure when doing the DCF? Do you assume an increase in ROU assets alongside PPE capex? And then net off lease liabilities?