May 2025: 7.1% Ahead of S&P

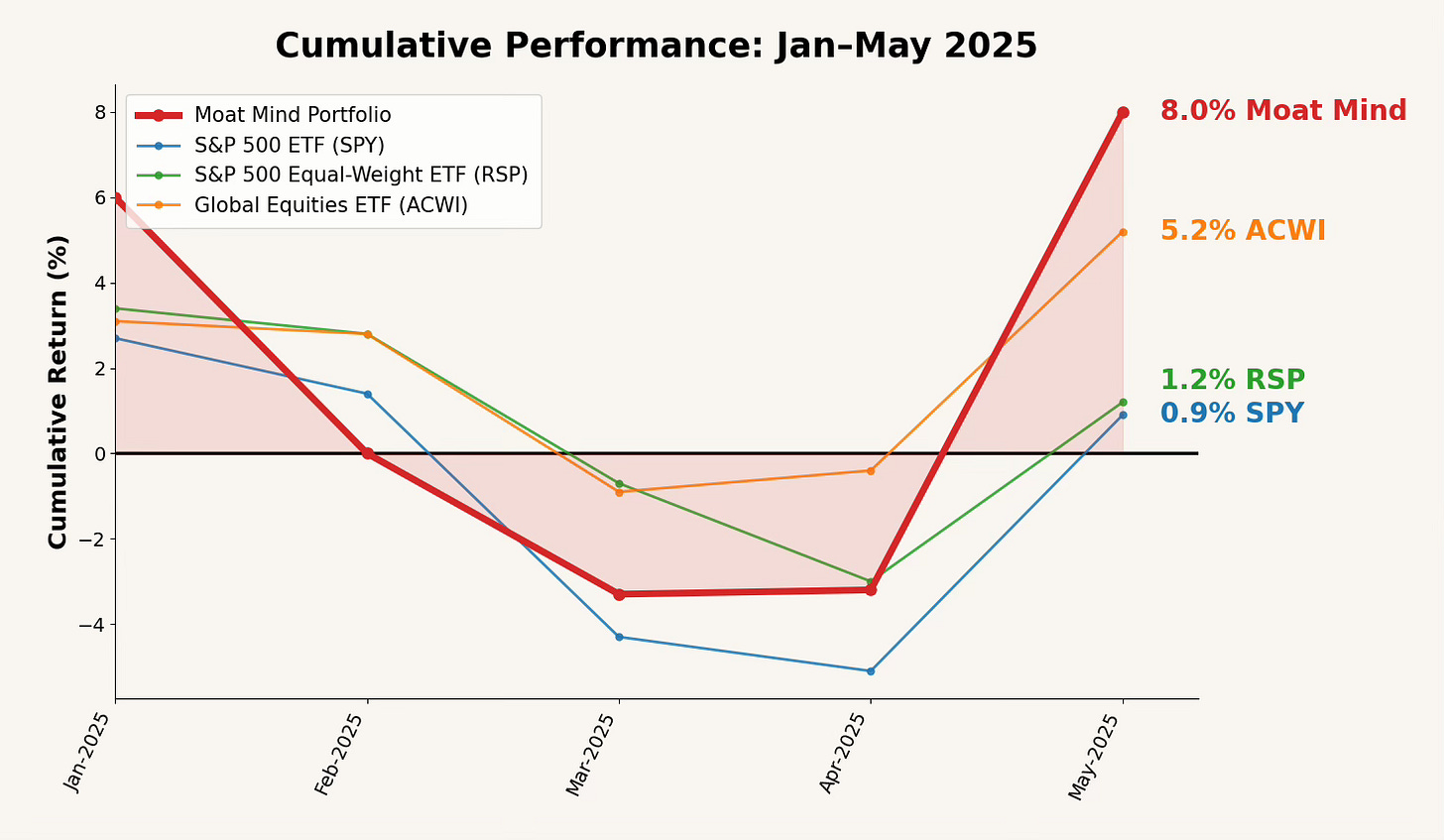

As of May 31, the portfolio is up 7.1% more than the S&P 500 year-to-date.

May 2025 marked a strong rebound for equities, with most major indices reversing course after a volatile first quarter. The Moat Mind portfolio advanced by 11.5%, outperforming the S&P 500 ETF (SPY) at 6.3%, the equal-weighted RSP at 4.3%, and the global ACWI index at 5.7%.

Year-to-date, Moat Mind now stands at +8.0%, comfortably ahead of SPY (+0.9%) and RSP (+1.2%), and slightly above ACWI’s +5.2%. This reflects a continued focus on buying high-quality companies at reasonable valuations — an approach that has begun to reward patience as markets broaden and fundamentals regain investor attention.

This month, we exited our position in BMW and initiated a new one in Century Communities. We also received dividends from Mercedes-Benz, BMW, and Century Communities. Additionally, Catana Group transitioned to Euronext Growth Paris and updated its ticker symbol to ALCAT.

📥 Full Access to Investment Engine

Join the Moat Mind Patreon to gain exclusive access to the live-updating portfolio, dynamic IRR-driven valuation models, and real-time alerts on every decision I make.

📊 Track portfolio weights and expected IRRs as they evolve with market moves.

🧠 Dive into the full DCF models behind each stock—transparent, data-rich.

📈 Follow a real-time watchlist of high-quality companies under active research.

🔔 Get instant alerts for every portfolio move and model update—no delays.

Whether you're allocating capital or studying the process, this is the real-time dashboard behind the strategy—built to help you invest with clarity, conviction, and a real-time edge.